Financial highlights

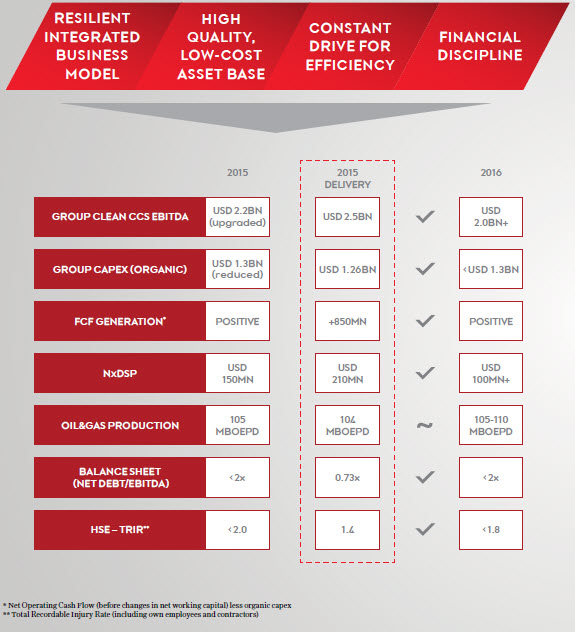

- MOL delivered USD 2.5bn (HUF 692bn) Clean CCS EBITDA in 2015, 13% higher than in 2014, and significantly outperforming its USD 2.2bn target

- Net operating cash flow (USD 2.11bn) exceeded organic CAPEX (USD 1.26bn) by USD 850m, implying very strong free-cash flow generation and leading to an even more robust balance sheet (Net debt/EBITDA at a mere 0.7x) in 2015

- MOL booked sizeable impairment charges of HUF 504bn (USD 1.7bn), mostly driven by the low oil price environment

- Downstream was the earnings engine of the group in 2015 with its best performance of USD 1.65bn Clean CCS EBITDA

Operating highlights

- Upstream production grew by 7% in 2015 to 104 mboepd

- Hungarian and Croatian crude output rose by 5% and 20% year-on-year, respectively

- Next Downstream Program delivery was ahead of plans (USD 210mn EBITDA contribution in 2015)

- New butadiene plant launched commercial production in Hungary

- Captive retail market continued to expand further with the acquisition of the ENI networks in Hungary and Slovenia

- Strong motor fuel demand growth (5%) in the core CEE market was a tailwind in 2015

- A substantial year-on-year decrease (-23%) in injury rate (TRIR) for own staff in 2015

- RobecoSAM Sustainability Yearbook inclusion means MOL is now top 15% in global oil & gas industry based on its sustainability performance

Outlook

- To maintain a strong balance sheet and ample liquidity

- Resilient integrated business model to absorb external shocks, generate strong cash flows

- To generate at least USD 2.0bn group CCS EBITDA in 2016 even under a USD 35-50/bbl oil price scenario (and at USD 4.0-5.0/bbl Group Refinery margin and at EUR 400-500/t Integrated Petchem margin)

- Organic capex plan for 2016 cut to up to USD 1.3bn from „up to USD 1.5bn” (at USD 35-50/bbl oil price)

- Sustainable free cash flow generation; its operating cash flows should continue to be able to cover both investments and dividends to shareholders

- Upstream: aiming for self-funding operations at USD 35/bbl after substantial cost-side adjustment

- Downstream: continue to be boosted internally through efficiency and growth; Next Downstream Program to partly offset potential macro normalization

- Cautious, opportunistic view on M&A

- To continue to increase distribution to shareholders, aiming for simpler shareholder structure

- To implement „Sustainability Plan 2020”